The Crowding-out Effect Is the Tendency for

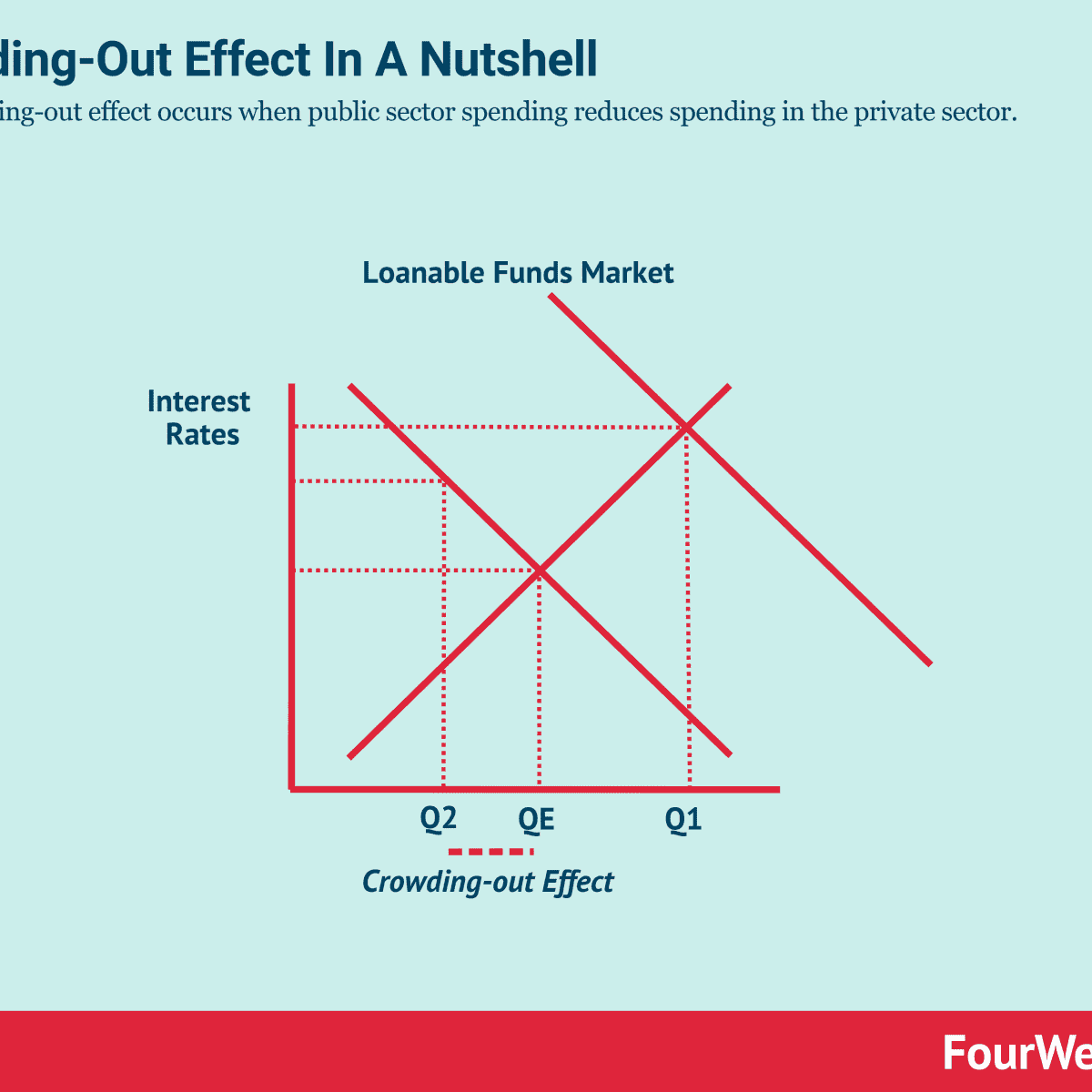

The crowding-out effect is an economic theory that argues that rising public sector spending drives down private sector spending. Cause decreases in planned expenditures in the private sector.

Solved The Crowding Out Effect Is The Tendency For O A Chegg Com

It does not decrease investment by full amount of the government budget deficit because a higher real interest rte induces an increase in private saving that partly contributes toward financing the deficit.

. School Diablo Valley College. Raising taxes or borrowing. Crowding out effect the tendency for budget deficit to raise the real interest rate and decrease investment.

The crowding-out effect suggests that the increase in government spending triggers a decrease in private investments in the country. The demand for loanable funds increases. Definition of Crowding Out Effect.

The crowding out effect is an economic theory arguing that rising public sector spending drives down or even eliminates private sector spending. Crowding out effect is the tendency for a government budget deficit to raise. The most common one occurs when escalation in government borrowing due to expansionary fiscal policies increases the demand for loans and subsequent rise in interest rate curtailing private spending.

The Crowding Out Effect -The tendency for increases in government spending to cause offsetting reductions in spending in the private sector -Sometimes government spending just replaces private spending. Higher government budget deficits to increase total savings. The crowding-out effect is the tendency for a government budget deficit to _____ the real interest rate and decrease _____.

A situation when increased interest rates lead to a reduction in private investment spending such that it dampens the initial increase of total investment spending is called crowding out effect. The crowding -out effect is the tendency for O A. Higher taxes mean consumers and companies have less left over to spend.

Solution for The crowding-out effect is the tendency for a government budget deficit to raise the and investment. Higher government budget deficits to decrease investment. International crowding out is the tendency of expansionary fiscal policy to appreciate the countrys currency and worsen the current account.

It can be of different types. If government reduces tax rates or increases its expenditure it results in increasing fiscal deficit expensesincome. Answer 1 of 5.

Sometimes government adopts an expansionary fiscal policy stance and increases its spending to boost the economic activity. International crowding out is the tendency of expansionary fiscal policy to appreciate the countrys currency and worsen the current account. According to the Ricardo-Barro effect when a government budget deficit occurs.

According to the Ricardo-Barro effect a government budget deficit leads to the crowding-out effect. According to the Ricardo-Barro effect rational taxpayers know that a budget deficit today means that future taxes will be higher and future disposable incomes will be smaller. The crowding-out effect is asked Jul 4 2016 in Economics by rakuman78 A the tendency of expansionary fiscal policy to cause an increase in planned investment but not in planned consumption in the US.

Solution for The crowding-out effect is the tendency for a government budget deficit to raise the and investment. Lower private saving to increase the budget deficit. Asked Apr 25 2020 in Economics by Bobby.

Crowding out effect is the tendency for a government. Course Title SOCIO 01. The crowding-out effect refers to the tendency of expansionary fiscal policy to.

In order to cover this deficit government will tend to. The crowding-out effect refers to the tendency of. The crowding-out effect refers to the tendency of expansionary fiscal policy to asked Jul 14 2016 in Economics by Attractive A cause decreases in planned investment or planned consumption.

Fiscal policy is related to tax and expenditure powers of government. This is the correct answer. The government can boost spending by doing two things.

Asked Aug 16 2019 in Economics by jsantos32387. Pages 12 This preview shows page 5 - 7 out of 12 pages. Higher private savings to decrease government budget surpluses.

Crowding out effect The tendency of expansionary fiscal policy to cause a from ECON SUPPLY AND at University of Texas Dallas. The crowding-out effect is A the tendency of contractionary fiscal policy to cause an increase in planned investment or planned consumption in the US. Cause firms to produce above their full capacity.

The crowding-out effect refers to the tendency of expansionary fiscal policy to. Lower private saving to decrease investment. Most government borrowing involves selling bonds.

Asked Aug 16 2019 in Economics by jsantos32387. A government budget deficit _____ the real interest rate because _____.

Crowding Out Effect And Why It Matters Fourweekmba

Crowding Out Effect And Why It Matters Fourweekmba

Comments

Post a Comment